The impact of such academic work can go unrecognized for decades. The current account and the capital and financial account.

Pdf Asymmetric Information Firm Investment And Stock Prices

The Effect Of Asymmetric Information On Turkish Banking Sector And Credit Markets Cairn Info

Solved Asymmetric Information In Financial Markets Is A Chegg Com

The Act also identifies and prohibits certain types of conduct in the markets and provides the Commission with disciplinary powers over regulated entities and persons associated with them.

Asymmetric information in financial markets. This includes bankers fund managers security and currency traders in the worlds major financial centres but also increasingly extends to the finance departments of public and private sector organizations. It is a third. WB a leading social media for people to create share and discover content will.

The liquidity series is split into two subsamples namely pre-GFC July 22 2005September 12 2008 that is presented in Panel B of Fig. Thus lowering the problem of asymmetric information. In these markets the borrower has much better information about his financial state than the lender.

1 to enable a closer examination of the liquidity seriesThe period from September 13 2008 to December 8 2008 is omitted to avoid muffling of the plots due to. The Act also empowers the SEC to require periodic reporting of. Based on the information gathered from nutritional studies the nutritionist recommends the intake or avoiding of food items as per the dietary and physiological demand of the body.

Asymmetric information is a problem in financial markets such as borrowing and lending. The lender has difficulty knowing whether it is likely the borrower will default. The laws of demand and supply continue to apply in the financial markets.

Such clauses are common in international contracts especially in financial agreements. In 1996 a Nobel Prize was given to James Mirrlees and William Vickrey for their research back in the 1970s and 1970s on incentive problems when facing uncertainty under asymmetric information. In which the private owners of capital goods hire labour to produce goods and services for sale on markets with the intent of making a profit.

Asymmetric information occurs when one party to a transaction has more or superior information compared to another. Balance of payments account. At Crestones most recent investment forum we asked panellists to share their views on the likely path of markets and the global economy in 2022.

Financial market and institutions 1. The fund tries to generate asymmetric returns or what ASYMmetric ETFs defines as the ability to make money in down markets and capture the majority of bull market returns. The Economics of Money Banking and Financial Markets 7th20190515 79756 3jbzpu.

An example is the problem of asymmetric information in insurance. Futures and options which are both derivative securities are increasingly used by many participants in financial markets. Financial markets often rely on reputation mechanisms.

1 and post-GFC December 9 2008December 31 2018 that is presented in Panel C of Fig. Mishkin Chapter 1 and Chapter 2. Mutual funds help pool savings of individual investors into financial markets.

Asymmetric information in the financial markets can occur whenever either the buyer or seller has more information on the past present or future performance of an investment. The food and nutrition research focus on diverse aspects by taking the socio-economic implications into account. The intent of the editors is to consolidate Emerging Markets Review as the premier vehicle for publishing high impact empirical and theoretical studies in emerging markets financePreference will be given to comparative studies that take global and regional perspectives detailed single country.

In particular we asked to what extent risks from the recent Delta outbreak stickier inflation and signs that central banks are starting to withdraw stimulus. Information asymmetry began to grow in prevalence in academic literature. The refusal of the French Supreme Court Cour de cassation to enforce an asymmetric jurisdiction clause in its decision against Banque Privée Edmond de Rothschild in 2012 and again in March 2015 in its decision against Credit Suisse caused consternation.

According to the law of demand a higher rate of return that is a higher price will decrease the quantity demandedAs the interest rate rises consumers will reduce the quantity that they borrow. Financial markets and Institutions Required Reading. A financial intermediary is an entity that facilitates a financial transaction between two parties.

3 2021 PRNewswire -- Weibo Corporation NASDAQ.

Pdf Impact Of Asymmetric Information On The Investment Sensitivity To Stock Price And The Stock Price Sensitivity To Investment

Pdf The Impact Of Asymmetric Information On Foreign Portfolio Investment Flow Semantic Scholar

Pdf Asymmetric Information In Financial Markets Introduction And Applications Semantic Scholar

Asymmetric Information In Financial Markets Introduction And Applications Bebczuk Ricardo N 9780521797320 Amazon Com Books

Economics And Finance Part 2 Ing Pavel Babka

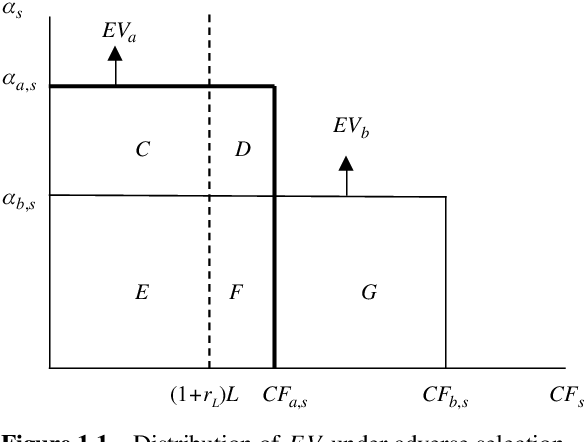

Prezentaciya Na Temu Outside Financing Under Asymmetric Information Plan For This Part Lemons Problem In Financial Markets Market Breakdown Market Breakdown Overinvestment Skachat Besplatno I Bez Registracii

1

Contract Design The Problem Of Information Asymmetry